So let me recap a little history about my decades-long experience with Capital One.

Way back in the early 90s when I had already burned my credit to the ground a few years earlier, both Wayne and I, wanting to get back into the groove of being credit card wielding Material Girls, applied and were accepted for accounts through a bank that specifically targeted folks like us that had less than stellar credit. The bank was called Signet Bank.

Now they weren't the first to come up with the idea of secured credit cards, but I think they were one of the first to actually extend the credit beyond what the savings account held. You see secured credit cards generally give you the ability to use a credit card that is backed by your savings account with the bank sponsoring the card. $1,000 savings account usually equals $1,000 line of credit. Signet offered another 50% above the amount in savings as part of your credit line. $1,000 in savings equaled $1,500 credit line. Now this is, of course, not factoring in any fees, outrageous interest rates, and any other incidental charges, but still, this was the best option that Wayne and I could hope for back in the day.

So as far as me, since I don't know exactly how Wayne handled his account as the years went on, I was able to actually increase the percentage of credit line above my secured savings for, I would say, the next couple years.

Sometime, I guess, in the mid 90s, my little Pinocchio card became a real boy. No longer was the credit line tied to any savings account, it was a full-fledged credit card with a $3,500 line of credit. It seems, according to my memory, not long after that, Signet Bank, for some reason, changed names and was now called Capital One.

Fast forward to 1997, I quit my job at RIARC, moved to Florida, and had the full advantage of this credit card along with the couple grand I had from my 403b cash out. As I've mentioned several times before, with my Corona Summer attitude that year, this didn't last long.

Before long, I racked up the credit card, exhausted my savings, and was broke. Not being able to make payments on the card, I let it go into collections, they pestered me for a while, but with all the moving around that I did during those days, they lost track of me.

Fast forward again, it's maybe 2018, and I have much improved credit. I'm bulking up on credit cards. I come across an offer for another credit card through Capital One. I think, of course, they're not going to approve me since I burned them before. But they do approve me, and at a pretty high credit limit.

Fast forward again later that year to Operation Veruca. I burn them again, this time, for over $7,000.

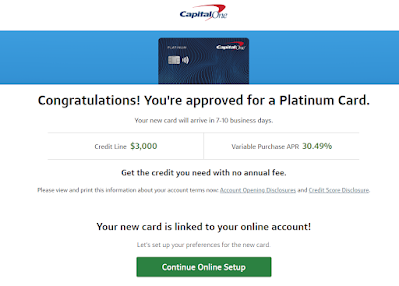

Fast forward to this week. I get another mailer in my mailbox as I've been getting for quite a few months now. But instead of those really sketchy high interest, high fee loser credit cards, I get an offer from Capital One. I toss it in the trash along with all the others. But then, almost on a whim, I get the idea, well, what if? So I respond online to the mailer, and lo and behold, you can see above, I got approved for a $3,000 line of credit Platinum Card.

Here we fuckin' go again!

I don't know who's more pitiful...me, or them?