2023, Party's over, outta time

Tonight I'm gonna party like it's 2022.

Welp, I gave it my best shot.

Kept expenses down (never mind those cruises...one must have SOME fun), pulled the Op V trigger, made fairly good bank from said action, bought this trailer I'm in way down in cheapsville eastbumfuck and planned it all out.

But until today, I hadn't really put nose to grindstone and crunched the cold, hard numbers. My rough estimate was always in the range of having up to, or pretty close enough to Social Security kicked in. The facts are, I ain't gonna make it. Not even close.

Of course I'm talking about this pre-retirement I'm on. I so wanted it to be a real retirement that I've just been strolling along as if it was. That savings account looks so robust. Ah, but as we damned well know from many years of experience, that starts to cascade downhill really, REALLY fast, really, REALLY soon if you're not ready for it.

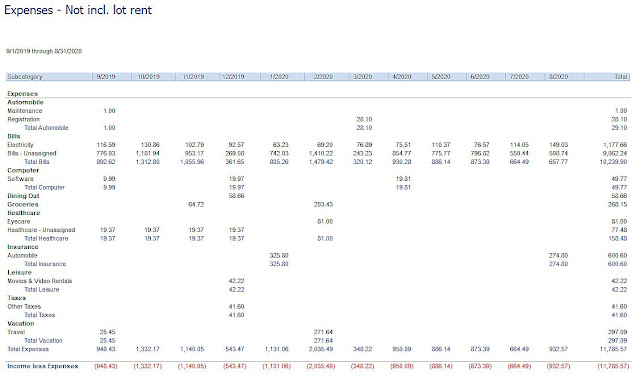

Here are the obligatory tables. The first indicates where we're at currently with regard to expenses. I wanted to take a sample of an annual snapshot outside of the rat-a-tat-tat cruise craziness of 2019 and this accounting has only one cruise in its computation so it's fair enough to say, factoring be it cruising or theme parks or airfare/hotel vacations, I'm likely gonna want to keep doing that...especially once this Covid shit is over with. As you can see from the totals, I'm averaging near $1,000 a month in expenses. This should be a fair basis to build on.

It can even compensate for anomalies like today, I have yet another flat tire on Hulk so I'm taking him into Tire Kingdom, plunking $450 down and getting a whole new set of tires. I'm fucking over that amber Mille Bornes "creve!" symbol.

(Well that's it, isn't it. My car's been hinting it to me all these years. I'm living a Mille Bornes game and I have a financial flat tire. I've been leaking slowly but surely all along. And I have no Coup Fourre card to play.)

Along with an inflation-creeping lot rent, off-set by savings distributions, I can make it to about December 2022. Then I'm outta dough. But what about the IRA? Well, if I cash it out then, when I frankly need it, it's only ten months shy of my 59 and one half milestone where I can do so without the 10% penalty. What about the Rule of 55? That's only available if I'd kept the funds in the 403b that it was in but I rolled it over into my own IRA so I can't withdraw from it without penalty despite not working since my termination. Plus, I was fired four days before my 54th birthday anyway. (I always seem to get fired around my birthday...hmm.)

And ultimately, even if I did bite the bullet and start deducting money from my IRA, I'd be looking at maybe some $50K after taxes and penalty, factoring in for the mediocre growth I've experienced in the past few years to continue to 2022. With each withdrawal, the potential gains are reduced and I would likely need some 20% more than those gains to make ends meet. So I figure when it's all said and done, maybe it'd last to see me through 2024 if I slashed a couple grand from annual expenses in that year. But then, it's really over. No more money. Period.

And I'm still a year and a half away from age 62 and one month (May 2026).

And, here's what the calculation says I'd be getting. It's in future inflation-factored dollars, but it's still well short of my needs. I'd really need to get on Medicaid, Food Stamps, the whole welfare nine yards. And really, who thinks that'll be available. Not only are events right now jeopardizing that future economic picture, there also thought give, again from experience, to how a younger, more racially diverse set of "judges" would evaluate my fat, lazy, boomer, white male ass to need.

So, it looks like one of two things will need to happen in the next few years. Either I go back to work, probably in some measure for the rest of my life, or I just plan on abandoning the car I call my life with its mortal flat tire by the side of the road sometime halfway to the next decade.

C'est dommage! Au revoir. Jeu termine.